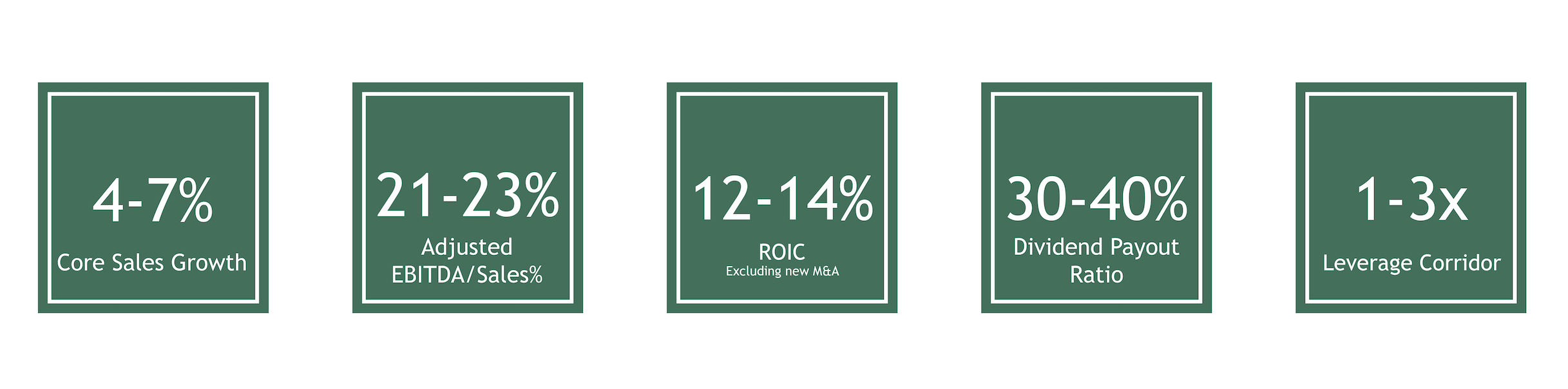

1 – Excludes acquisitions and currency effects.

2 – Adjusted EBITDA (earnings before net interest, taxes, depreciation and amortization) excludes restructuring initiatives, net realized investment gain/loss, transaction costs related to acquisitions, and non-recurring purchase accounting adjustments.

3 – ROIC (return on invested capital) = adjusted earnings before net interest and taxes, less tax effect / average capital (average of beginning of year and end of year capital) [capital = equity plus debt less cash].

4 – Cash dividends paid / adjusted earnings per share.

*Click here to see current Reconciliation of Non-GAAP Financial Measures.

This web content contains forward-looking statements, including our long-term financial targets. Our actual results may differ materially from those expressed or implied in such forward-looking statements due to known or unknown risks and uncertainties that exist in our operations and business environment. For more information, see here.